TL;DR: Revenue shows what you billed. Cash flow shows how stable your life actually was. Looking at the last 12 months reveals payment delays, stress points, and structural risks that revenue alone hides. Slow money, revenue spikes, and client concentration create ongoing strain. Better cash flow is not about working harder. It is about designing clearer terms, tighter systems, and more predictable payment so your business supports your energy, not drains it.

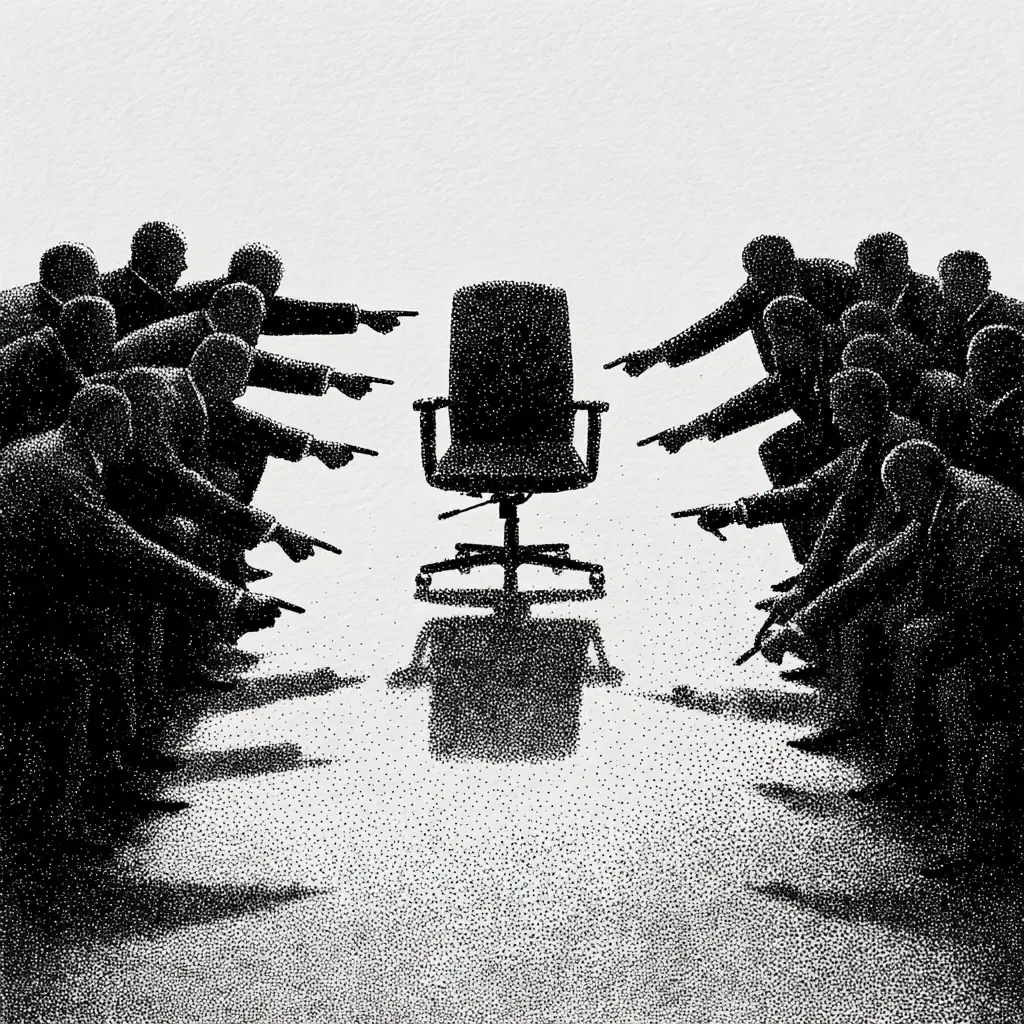

Revenue is comforting.

It is easy to point to. Easy to total. Easy to use as proof that the year was productive and worthwhile.

Cash flow is less flattering.

It shows delays, gaps, stress points, and dependencies. It reveals where money arrived late, unpredictably, or not at all. It exposes how much of your time was effectively financed by you.

If you want to understand the true health of your practice, revenue tells you what you earned. Cash flow tells you how you lived.

Why Revenue Is a Dangerous Standalone Metric

Revenue answers one question: how much work you billed.

It does not tell you when you were paid. It does not tell you how long you floated expenses. It does not tell you whether income arrived in a way that supported stability.

Two practitioners with identical revenue can have radically different lived experiences. One sleeps well. The other checks their bank balance daily.

The difference is cash flow.

What the Last 12 Months Reveal

Looking back over a full year removes the illusion of “this was just a weird month.”

Patterns emerge.

Which clients paid quickly and which consistently dragged?

Which months created anxiety regardless of revenue booked?

Where did gaps appear between work completed and cash received?

These patterns are not accidents. They are structural features of how your business operates today.

Ignoring them guarantees they repeat.

The Hidden Cost of Slow Money

Slow payment is not neutral.

It shifts risk onto you. It forces you to self-finance client operations. It increases cognitive load and decision fatigue. It constrains your ability to plan, invest, or say no.

Many practitioners normalize this as part of freelancing.

It is not inevitable. It is a business design choice, even when it does not feel like one.

Revenue Spikes Can Mask Fragility

Big months feel good. They can also hide weakness.

A single large client. A one-time project. A short-term surge that props up an otherwise unstable pattern.

When revenue spikes are followed by dry spells, the nervous system never resets. You oscillate between relief and anxiety.

Cash flow analysis smooths the story. It shows whether your income supports continuity or relies on bursts of intensity.

Where Cash Flow Problems Actually Come From

Cash flow issues rarely come from one thing.

They emerge from combinations of:

- Long payment terms

- Front-loaded effort with back-loaded payment

- Unclear scope that delays invoicing

- Clients who require chasing

- Inconsistent invoicing practices

Each on its own feels manageable. Together, they create persistent strain.

The fix is rarely working harder. It is tightening the system.

What to Look at Before Planning Next Year

Before setting goals or rates, look at three things.

First, average time to payment.

How long does it actually take from invoice to cash?

Second, revenue concentration.

How much of your income depends on one or two clients?

Third, buffer adequacy.

How many months could you operate if payments slowed or stopped?

These are not pessimistic questions. They are stabilizing ones.

Designing for Predictable Cash Flow

Better cash flow does not require perfect clients.

It requires clearer terms, firmer boundaries, and consistency.

Upfront deposits. Shorter payment windows. Regular billing cadences. Consequences for late payment that are enforced calmly and consistently.

These are not aggressive moves. They are signals that your work is a business, not a favor.

Clients who respect your value adapt quickly. Those who do not reveal something important.

The Psychological Relief of Predictability

One of the least discussed benefits of improved cash flow is mental space.

When money arrives predictably, planning becomes easier. Risk feels manageable. Decisions are less reactive.

You stop borrowing emotional energy from future months to survive the current one.

That stability supports better work, not just better finances.

Cash Flow Is a Design Problem

If your cash flow causes stress, it is not a personal failing.

It is a design issue.

Design can be changed.

You can redesign how work is scoped, billed, and collected. You can redesign how much risk you carry versus your clients. You can redesign the assumptions you inherited about how independent work is supposed to feel.

Final Thought

Revenue tells you what your work is worth. Cash flow tells you whether your business respects your time and energy. Before you plan the year ahead, make sure you understand the difference.

ChangeGuild: Power to the Practitioner™

Now What?

- Run a 12-month cash reality check.

Pull your last year of invoices and mark the actual payment dates. Calculate your real average time-to-payment, not what your contracts say. This is your baseline. - Name your slow-money clients.

Identify which clients consistently pay late or require chasing. Decide in advance whether they get new terms, higher rates, or less priority next year. - Fix one structural leak, not everything.

Choose a single improvement to implement immediately: an upfront deposit, shorter payment terms, or a consistent billing cadence. Small changes compound fast. - Stress-test your dependency risk.

Ask a simple question: if your largest client paused for 60 days, what breaks? Use the answer to guide diversification or buffer planning. - Design for calm, not just growth.

When setting next year’s goals, prioritize predictability over peak months. Aim for income patterns that reduce anxiety and cognitive load, not ones that require constant recovery.

These steps do not optimize your business. They stabilize it. And stability is what makes everything else possible.

Frequently Asked Questions

Why isn’t revenue a reliable indicator of business health?

Revenue only shows what you billed, not when you were paid or how much financial stress you absorbed in the meantime. Cash flow reflects the lived reality of running the business.

How do I know if I have a cash flow problem?

If you regularly wait on payments, feel anxious between invoices, or rely on a few big months to carry you through the year, you likely have a cash flow design issue even if revenue looks strong.

Is slow payment just part of freelancing or consulting?

It is common, but it is not inevitable. Slow payment usually comes from choices around terms, billing structure, and boundaries, not from the nature of independent work itself.

What is the single most important cash flow metric to track?

Average time to payment. Knowing how long it actually takes to get paid is more useful than monthly revenue totals when planning stability.

Do better cash flow terms scare off clients?

Clear terms tend to repel only clients who expect you to absorb their risk. Clients who value your work usually adapt quickly and respect the clarity.

How much of a cash buffer should I aim for?

A common starting point is two to three months of operating expenses. The right number depends on payment variability and client concentration.

Can raising rates fix cash flow problems?

Sometimes, but not always. Higher rates do not help if payments are still delayed or unpredictable. Structure usually matters more than price.

Is this about being aggressive with clients?

No. It is about being consistent and professional. Predictable billing and enforced terms are signals of a well-run business, not hostility.

When should I address cash flow, planning or mid-year?

Before planning. Cash flow patterns shape what goals are realistic and sustainable in the year ahead.

What if my cash flow stress feels personal?

It is not. Cash flow stress is almost always a design problem. And design problems can be changed.

This post is free, and if it supported your work, feel free to support mine. Every bit helps keep the ideas flowing—and the practitioners powered. [Support the Work]